At Chesapeake Bank, we believe that banking should be more than just a series of transactions —it should be about building lasting relationships that help our customers thrive. This philosophy is at the heart of our relationship banking approach, where we prioritize understanding and meeting the unique financial needs of every individual who walks through our doors.

What is Relationship Banking?

Relationship banking is more than just offering products and services; it’s about knowing our customers, understanding our goals, and providing solutions tailored to their specific needs. Our retail teams work hand-in-hand to assess and anticipate our customer’s needs, ensuring that no opportunity to enhance their financial well-being is missed.

Why Does Relationship Banking Matter?

For us, relationship banking is not just a saying—it’s our way of guaranteeing that our customers feel valued and supported throughout their financial journey. Here’s how we make a difference:

- Personalized Financial Solutions: We understand that our customers are not account numbers; they are individuals with unique goals and dreams. Whether it’s helping a young couple secure their first home or assisting a retiree in managing their investments, our team is dedicated to providing customized solutions that align with their life stages.

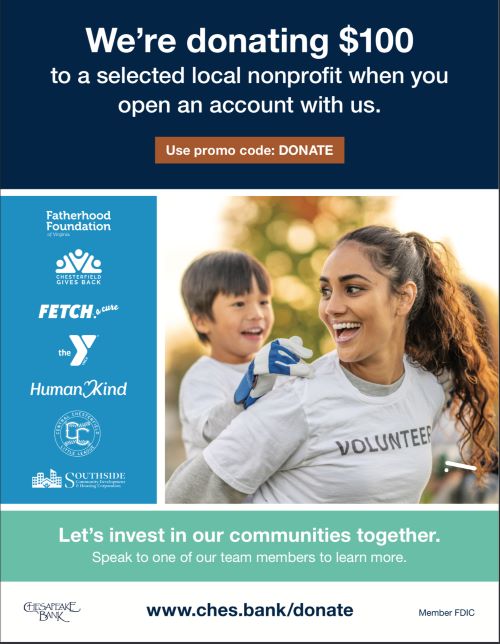

- Impactful Campaigns: We are committed to making a positive impact in our community through meaningful initiatives. A standout example of this is our campaign that allows you to make a difference when opening a new checking and savings account, which results in Chesapeake Bank donating $100 to a selected nonprofit. * This campaign is just one of the examples of how we combine our banking services with community support, allowing you to contribute to local causes while managing your finances.

- Innovative Features: We offer features designed to add value to our customers’ lives. For example, we offer Round-Up Savings, a feature that helps customers effortlessly save by rounding up their debit card purchases and transferring the extra change into their savings accounts. We also offer our Sweep feature, which allows customers to automate transfers between their checking and savings accounts, ensuring their funds are always in the right place when needed.

- Seamless Banking Experience: We have invested in intuitive mobile and online platforms that make managing finances easier than ever. Whether it’s monitoring accounts, paying bills, or transferring money, our digital tools are designed to integrate all internal and external accounts for a seamless banking experience. When it’s time to think about retirement, our customers consult with us to open an IRA, confident that Chesapeake Bank will continue to offer the support and products they need at every stage of their life. This is relationship banking in action—proactively helping our customers achieve their financial goals while deepening their connection to our bank.

* Campaign ended 9/11/2024

Relationship Banking vs. Transactional Banking

While transactional banking focuses on meeting immediate needs with quick, one-time services, relationship banking is about the bigger picture. At Chesapeake Bank, we prioritize understanding our customers’ unique needs and providing personalized solutions that evolve with them over time. This approach promises that our customers feel valued and supported throughout their financial journey.

To truly understand the difference relationship banking can make, it helps to hear from someone who embodies this philosophy every day. Jill Ortiz, our VP Regional Manager for the Middle Peninsula and Northern Neck regions, is a shining example of the personal care and community commitment that Chesapeake Bank stands for. With her deep knowledge of financial solutions and her active role in the community, Jill believes that true success comes from building strong, lasting relationships.

As Jill puts it: “Build your reputation by helping other people build theirs. I enjoy supporting our local businesses and seeing our customers out and about in the community.”

Jill’s dedication to both her customers and the local community reflects the core values of relationship banking at Chesapeake Bank. Whether you’re looking to open your first account, planning for the future, or seeking ways to give back, Jill is always ready to lend a helping hand and guide you through every step of the process.

Experience the Chesapeake Difference

As community bankers, we take pride in being more than just a financial institution—we are partners in our customers’ success. Whether it’s through personalized financial planning or simply being a familiar face in the community, our goal is to make every customer feel valued and supported.

At Chesapeake Bank, relationship banking isn’t just a buzzword; it’s the foundation of how we do business. We invite you to experience the change for yourself and see how our commitment to relationship banking can make all the difference in your financial journey.