Quarterly Commentary Q1 2024

Market Overview

Global equity markets got off to a promising start during the first quarter. While the S&P 500 led all broad market measures, the gains were generally across the board including all styles (growth/value), market capitalizations, and geographical regions. Building on strong performance from the fourth quarter of 2023, the three U.S. large-cap indices reached new highs with the S&P 500 having its largest first quarter gain since 2019. Though this quarter saw more participation from the broader market, equity

performance over the last year has been quite narrow and influenced heavily by large-cap technology stocks.

Despite higher interest rates, the economy and labor markets are doing better than most economists predicted. The housing market is stable, and while consumer spending has slowed, it remains positive. Consumer demand, on the other hand, especially for services, has led to inflation remaining above the Fed’s two-percent target. With inflation near three-percent, the Fed has kept rates at their current target level. Entering the second quarter, markets were pricing in just a fifty-percent chance of a rate cut in June which just a few months ago seemed to be a near certainty.

Market dynamics appear to be implying a higher “neutral” federal funds rate that neither stimulates nor inhibits growth. The economy has remained strong even as the Fed increased its target rate, suggesting that the current level may not be as restrictive as once thought by a number of FOMC board members. The good news is that the economy is expected to continue to grow throughout 2024. Furthermore, analysts expect that earnings growth will broaden beyond the technology sector. If this can be achieved and sustained without driving inflation higher, we may yet see the Fed’s first rate cut before yearend.

Performance

Once again, a major theme that influenced first quarter market performance continued to center around inflation. With this in mind, all eyes and ears were on the Fed waiting for an indication for the timing of their initial rate cut. Other factors that would play into the Fed’s decision were housing market data, corporate earnings, and the labor market. By quarter-end, it became apparent that inflation might be stickier than previously hoped. This resulted in the market pricing in a delayed rate hike to the second quarter or beyond. Another important theme that began last year and continued into this year has been the developments in generative artificial intelligence stocks. Nvidia has become the poster child of this group as it gained over 80% in the first quarter alone.

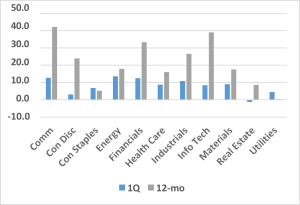

The S&P 500 gained 10.6% for the quarter while the DJIA rose 5.6% and the NASDAQ Composite Index advanced 10.9%. Overall, by sector, performance was strong across the board with only one sector (real estate) declining over the three-month period. Five of eleven sectors advanced by ten percent or more, led by communication services (+15.1%), information technology (+12.3%) and financials (+12.0%). The largest turnaround from the fourth quarter was the energy sector which was down 9.6% to end the year and rebounded to gain 10.8% in the first quarter.

S&P 500 Sector Performance (ETF)

The good news wasn’t limited to the U.S. large-cap market. As mentioned above, all equity asset classes benefited during the quarter. In the U.S., the Russell Mid-Cap Index gaining 8.6% and the Russell 2000 Index up 5.2%. These two markets began to rally during the fourth quarter based on the prospect of lower rates and that rally continued into the new year.

International

International developed markets, as measured by the MSCI EAFE, gained 5.9%. Despite the overall return, performance was a mixed bag region-wise. Japanese stocks did well as the Bank of Japan ended its eight-year foray into negative interest rates. As for the Eurozone, the entire region continues to feel the effects of the war in Ukraine. As Europe scrambles to find ways to provide support, pressure has been building on fiscal resources, including energy and other materials. Adding to this pressure has been the conflict in the Red Sea and the subsequent re-routing of supply lines. Furthermore, a slightly appreciating U.S. dollar acted as a headwind toward these markets.

Emerging markets were up 2.4% for the quarter. The Chinese stock market set a new five-year low before rebounding to end the quarter with a positive return. The Chinese government’s focus has been on rebalancing the economy towards internal consumption and away from infrastructure and real estate. Needless to say, this will take quite some time. In contrast, Indian stocks performed well, lifted by optimism about the country’s growth trajectory.

Commodities

Commodities had positive returns in March, with energy as the outperformer while metals eked out a small positive net return, and agricultural commodities were mixed. Within the energy sector, all included commodities contributed positively – tight fundamentals and geopolitical concerns kept prices well supported – except for natural gas, which remained the weak link, pressured by ample supplies and weak heating demand. In agriculture, sluggish demand from China and favorable weather in Brazil kept grains under pressure. Industrial metals were mixed with copper ending slightly positive on tightening supplies, while aluminum and zinc retreated. Gold and silver were both positive as their safe- haven properties, central bank buying, and dovish Fed comments boosted demand.

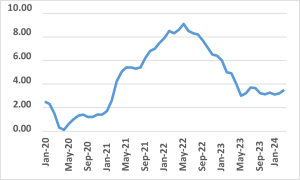

Crude Oil Prices - WTI

Fixed Income

The combination of a stronger economy and somewhat sticky inflation has pushed interest rates higher thus far in 2024. The current debate has shifted back to inflation, and whether or not it will fall enough to allow the Fed to begin lowering rates. As investors embraced risk assets given the improved economic situation and outlook for Fed cuts, corporate spreads tightened significantly. Agency mortgage-backed securities benefited less from this dynamic, offering an attractive alternative to corporate bonds by offering similar yields and less credit risk.

Despite an upward movement in yields over the quarter, municipal bond demand remained strong, even in the face of what is a historically weaker seasonal period ahead of the April tax deadline and an increase in quarterly issuance. Leading the demand cycle has been consistent growth in the municipal managed account assets as well as a shift in flows within the mutual fund complex. The supply and demand imbalance has been a consistent theme within the municipal market since late last year. From a credit perspective, municipal fundamentals remain broadly favorable. For state and local governments, a combination of higher economic growth, elevated home prices, and residual Covid- era stimulus have seen tax receipts rise and reserves balances bolstered.

Inflation

“Don’t fight the Fed” is a tried-and-true mantra for anyone with experience in the equity markets. The Federal Reserve’s campaign to halt inflation has been implemented through eleven interest rate hikes that brought the Fed Funds target to 5.25%-5.50%. While investors have gotten the message, the U.S. Government continues to “fight the Fed” through inflationary spending and borrowing which has driven the cost, ultimately borne by taxpayers, to concerning heights. As the Fed attempts to remove demand from the economy, the Executive and Legislative branches continue to flood the economy with stimulus in the forms of The American Rescue Plan of 2021 ($1.9tr), the CHIPS and Science Act ($280bn), the Inflation Reduction Act ($1tr and rising), plus roughly $100bn in unspent Covid relief stimulus, approximately $144bn in cancelled student debt, and a projected $1.6 trillion budget deficit in FY ’24. Given the frequent communication between the Fed and the Federal Government, it is perplexing how the actions of the latter so frequently work against those of the former. One would expect the two to be on the same page regarding spending and servicing the federal debt.

Consumer Price Index – YoY Change

Second Quarter Insights

The year began with debates over a “soft” versus “hard” landing as the Fed attempted to stabilize the economy as well as over the sustainability of last year’s market rally. Only three months later, those concerns have given way to a calmer environment centered around fading inflation and the Fed’s plans for reducing interest rates.

The economic environment has surprised many investors as inflation continues to fade. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures index, rose 2.5% on a year-over-year basis for all prices and 2.8% when excluding food and energy, both significant improvements from their peaks only a year and a half ago despite some areas of inflation such as shelter and energy costs that remain problematic.

Meanwhile, unemployment is still under 4% despite layoffs in the tech sector, interest rates have been more stable, and stock market returns have broadened beyond artificial intelligence stocks. Despite these positive trends, some investors are concerned about the upcoming presidential election and the next phase of Fed policy. These worries are only amplified by the fact that, until very recently, the market is hovering near all-time highs.

While price swings are an unavoidable part of investing, and the market does experience pullbacks from time to time, history shows that markets also tend to rise over long periods. During a bull market cycle, major stock market indices will naturally spend a significant amount of time near record levels. Taking a long-term perspective allows investors to benefit from these market trends without constantly worrying about when a pullback might occur. Holding an appropriately diversified portfolio can help investors to withstand market pullbacks without focusing too much on the exact level of the market.

Coverage of the presidential election is heating up ahead of a potential November rematch between Presidents Biden and Trump. While elections are an important way for Americans to help shape the direction of the country as citizens, it’s important to vote at the ballot box and not with investment portfolios. This is because history shows that markets can perform well under both Democrats and Republicans. Of course, politics can impact taxes, trade, industrial activity, regulations, and more. However, not only do these policy changes tend to be incremental, but also the exact timing and effects are often overestimated.

The market rally broadened beyond mega-cap technology stocks in the first quarter. The equal weight S&P 500, an alternative to the standard market cap-weighted index, hit a new all-time high in early March, a sign that a wider range of stocks is performing well. The positive economic outlook and the possibility of rate cuts have boosted optimism across many parts of the market. Given this backdrop, the Fed is expected to cut rates later this year although the timing remains uncertain. Regardless of the exact timing and path of Fed rate cuts, these projections represent a reversal of the emergency monetary policy actions that began in early 2022. For investors, it’s important to adapt to this changing environment and not focus solely on the events of the past few years.

Brian T. Moore

April 2024

References

- S&P 500 Sector Return Data

Morningstar: Third Quarter 2023 total return of ETF proxies. - Crude Oil Prices – WTI -

Federal Reserve Economic Data: Year to date, crude oil prices, West Texas Intermediate. - CPI – Year over Year Change -

Federal Reserve Economic Data: Year over year percentage change September 2023.

Disclaimer

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Chesapeake Wealth Management), or any non-investment related content, made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Chesapeake Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his or her individual situation, he or she is encouraged to consult with the professional advisor of his or her choosing. Chesapeake Wealth Management is neither a law firm nor a Certified Public Accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Chesapeake Financial Group, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.